IMPORTANT NEWS: Transition of investment management responsibilities

First Sentier Group, the global asset management organisation, has announced a strategic transition of Stewart Investors' investment management responsibilities to its affiliate investment team, FSSA Investment Managers, effective Friday, 14 November close of business EST.

Global Emerging Markets Leaders Fund

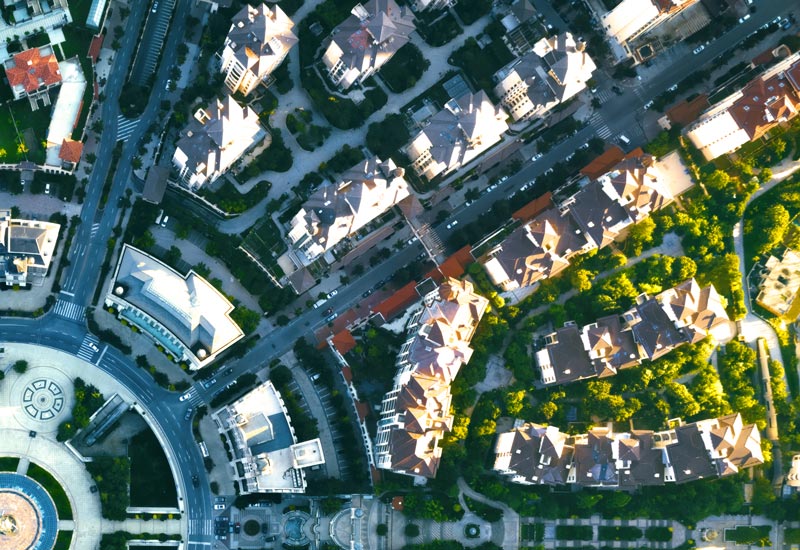

The strategy invests in 25-60 high-quality emerging markets companies that we consider to be well positioned to contribute to, and benefit from, sustainable development.

The Global Emerging Markets Leaders strategy launched in April 2020. It invests in 25-60 high-quality emerging market companies that we consider to be particularly well positioned to contribute to, and benefit from, sustainable development.

Investment Objective

- The Stewart Investors Global Emerging Markets Leaders Fund (the "Fund") seeks to achieve capital growth over the long term.

- Leaders simply means that the strategy is focused on companies with a market cap value of at least USD1 billion.

Strategy highlights: a focus on quality and sustainability

- Companies must contribute to sustainable development.

- We seek to invest in high-quality companies with exceptional cultures, strong franchises and resilient financials.

- We avoid companies linked to harmful activities and engage and vote for positive change.

- Our approach is long-term, bottom-up, high conviction and benchmark agnostic.

- We seek to achieve capital growth – we define risk as the permanent loss of client capital.

Documents

Our literature hub contains Annual and Interim Reports, Factsheets, Forms and applications, Portfolio Holdings and Prospectuses.

Factsheets

Available soon

Annual & Interim Reports

Available soon

Prospectus

An investor should consider the investment objectives, risks, and charges and expenses of the funds carefully before investing. A prospectus which contains this and other information about the funds may be obtained by visiting our literature hub. The prospectus and the summary prospectus should be read carefully before investing.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid, and more volatile than securities markets in more developed markets. The portfolio manager’s consideration of sustainability factors could cause the Funds to perform differently compared to similar funds that do not have such factors incorporated into their investment strategies. The Funds are new with no operating history and there can be no assurance that the Funds will grow to or maintain an economically viable size, in which case the Board may determine to liquidate the Funds.

The Stewart Investors Funds are distributed by Foreside Financial Services, LLC